The chart below should be a great encouragement to investors.

But first, let me say that at any given point in time, the stock market, for a billion different reasons, can make a sharp correction. Just because we recently recovered from one crash does not mean we’re protected from another one. The market is no respecter of our retirement portfolios – even the target-dated kind. If you don’t respect it, it will not respect you.

That said, let’s settle in on one very important comparison of stock prices.

My clients have heard me talk about the difference between GROWTH Stocks and VALUE Stocks. Growth Stocks are those whose stock price is high as compared to that company’s book price. The stock price (adding up all outstanding stocks) is the company’s market value – what you could sell it for as a going concern. The book price is that company’s accounting value – the value of all of the separate parts (computers, land, buildings, patents, etc.). If you see a stock that is selling at 4 or 5 times the book value, you generally have a GROWTH company stock. If you have a stock that is selling at or below the book value, you generally have a VALUE company stock.

We make the distinction between these two “kinds” of companies for two main reasons: First, the returns are better over time in value companies. Second, this attribute is helpful in finding asset classes that will move in different directions. In other words, we own both kinds of companies because we get a return premium for them AND we offset negative years by owning them together, giving the investor the benefit of higher returns and lower risk (volatility).

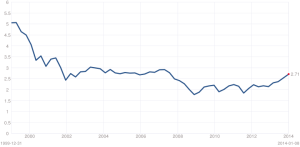

But there is more we can take away from knowing the book value of companies and the Price to Book (PTB) Ratio. See the chart below:

Current S&P 500 Price to Book Value: 2.69 -0.01 (-0.32%)

11:32 am EST, Mon Jan 6

Mean: |

2.75 |

|

Median: |

2.73 |

|

Min: |

1.78 |

(Mar 2009) |

Max: |

5.06 |

(Mar 2000) |